On Monday October 28, 1929, the stock market took one of the worst single-day tumbles anyone alive might have seen, with the Dow Jones averages falling about 13%. The next day, October 29th, the market dropped yet again, a decline of 12%. By the end of the year, the Dow Jones average was down more than 45% from its high of 381. Market historians are familiar with the rest of the story: The sickening slide would not stop at 45%, but continue until 1932 to reach a low of 41 on the Dow, a decline of about 90% from peak to trough.

American business was in a major Depression. But at least one businessman would decide that, like General Erwin Rommel would say years later, the path was not out, but through.

***

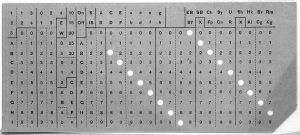

International Business Machines, better known as IBM, was created from the ashes of the Computing-Tabulating-Recording Company (C-T-R) in 1917 by Thomas J. Watson, who’d learned his business skills at the National Cash Register Company (NCR). Before Watson’s reorganization of C-T-R, the company was basically in three businesses: computing scales (to weigh and compute the cost of a product being weighed), time clocks (to calculate and record wages), and tabulating machines (which used punch cards to add up figures and sort them). Watson’s first act of genius was to recognize that the future of IBM was not going to be time cards or scales, but in helping businesses do their work more effectively and with a lot less labor. He set out to do just that with his tabulating machines.

The problem was, IBM’s products weren’t yet all that different from its competitors’, and the company was small. IBM’s main tabulating product was the Hollerith machine, created by Herman Hollerith in Washington D.C. in 1890 to improve the Census tabulating process, of all things. (It sounds mundane, but he saved the government $5 million and did the work in about 1/8th of the time.) By the late 1910s, the Hollerith machine had a major competitor in the Powers Accounting Company, which had a similar product that was easier to use and more advanced than the Hollerith.

Watson knew he had to push the research and development of his best product, and he did, hiring bright engineers like Fred Carroll from NCR, who would go on to be known for his Carroll Press, which allowed IBM to mass-produce the punch cards which did the “tabulating” in the pre-electronic days. By the mid-1920s, IBM had the lead. The plan was set in late 1927.

Watson then pointed to where he wanted IBM to go. ”There isn’t any limit for the tabulating business for many years to come,” he said. “We have just scratched the surface in this division. I expect the bulk of increased business to come from the tabulating end, because the potentialities are greater, and we have done so little in the way of developing our machines in this field.”

Underneath that statement lay a number of reasons—other than the thrill of new technology—why Watson zeroed in on the punch card business. When seen together, the reasons clicked like a formula for total domination. IBM would never be able to make sure it was the world leader in scales or time clocks, but it could be certain that it was the absolute lord of data processing.

[…]

Watson had no epiphanies. No voice spoke to him about the future of data processing. He didn’t have a grand vision for turning IBM into a punch card company. He got there little by little, one observation after another, over a period of 10 to 12 years.

(Source: The Maverick and his Machine)

Watson’s logical, one-foot-at-a-time approach was reminiscent of Sir William Osler’s dictum: Our main business is not to see what lies dimly at a distance, but to do what lies clearly at hand. And with a strategy of patenting its proprietary punch-cards, making them exclusively usable with IBM tabulators and sorters, IBM was one of the market darlings in the lead-up to 1929. Between 1927 and 1929 alone, IBM rose about four-fold on the back of 20-30% annual growth in its profits.

But it was still a small company with a lot of competition, and the punch card system was notoriously unreliable at times. He had a great system to hook in his customers, but the data processing market was still young — many businesses wouldn’t adopt it. And then came the fall.

***

As the stock market dropped by the day and the Depression got on, the economy itself began to shrink in 1930. GDP went down 8% that year, and then another 7% the following year. Thousands of banks failed and unemployment would eventually test 30%, a figure that itself was misleading; the modern concept of “underemployment” hadn’t been codified, but if it had, it probably would have dwarfed 30%. An architect working as a lowly draftsman had a job, but he’d still fallen on hard times. Everyone had.

Tom Watson’s people wondered what was to become of IBM. If businesses didn’t have money, how could they purchase tabulators and punch cards? Even if it would save them money in the long run, too many businesses had cut their capital spending to the bone. The market for office spending was down 50% in 1930.

Watson’s response was to push. Hard. So hard that he’d take IBM right up to the brink.

IBM could beat the Depression, Watson believed. He reasoned that only 5 percent of business accounting functions were mechanized, leaving a huge market untapped. Surely there was room to keep selling machines, even in difficult times. Watson also reasoned that the need for IBM machines was so great, if businesses put off buying them now, certainly they’d buy them later, when the economy picked up. His logic told him that the pent-up demand would explode when companies decided to buy again. He wanted IBM to be ready to take advantage of that demand.

He’d keep the factories building machines and parts, stockpiling the products in warehouses. In fact, between 1929 and 1932, he increased IBM’s production capacity by one-third.

Watson’s greatest risk was running out of time. If IBM’s revenue dropped off or flattened because of the Depression, the company would still have enough money to keep operating for two years, maybe three. If IBM’s revenue continued to falter past 1933, the burden of running the factories and inventory would threaten IBM’s financial stability.

[…]

Watson’s logic led him to make what looked to outsiders like another insane wager. On January 12, 1932, Watson announced that IBM would spend $1 million—nearly 6 percent of its total annual revenue— to build one of the first corporate research labs. The colonial-style brick structure in Endicott would house all of IBM’s inventors and engineers. Watson played up the symbolism for all it was worth. He would create instead of destroy, despite the economic plague.

(Source: The Maverick and his Machine)

Most companies pulled back, and for good reason. Demand was rapidly shrinking, and IBM’s decision to spend money expanding productive capacity, research, and employment would be suicide if demand didn’t return soon. All of that unused capacity was costly and would go to waste. Watson took an enormous risk, but he also had faith that the American economy would recover its dynamism. If it did, IBM would come out on the other side untouchable.

Somehow, Watson had to stimulate demand. He had to come up with products that companies couldn’t resist, whatever the economic conditions. Again, thanks to Charles Kettering’s influence, Watson believed that R&D would drive sales. (ed: Kettering was chief engineer at General Motors.) So Watson decided to build a lab, pull engineers together, and get them charged up to push the technology forward.

Throughout the 1930s, IBM cranked out new products and innovation, finally getting its technology ahead of Remington Rand or any other potential competitors.

[…]

Within a few years, Watson’s gamble of manufacturing looked disastrous. As IBM pumped increasing amounts of money into operations and growth, revenue from 1929 to 1934 stalled, wavering between $17 million and $19 million a year. IBM edged toward insolvency. In 1932, IBM’s stock price fell to 1921 levels and stayed there—11 years of gains wiped out.

(Source: The Maverick and his Machine)

By 1935, IBM was still stagnating. Watson made the smart move to get out of the money-losing scale business and use the money to keep the remaining businesses afloat, but he was drowning in excess capacity, inventions be damned.

Then IBM got a stroke of luck that it would ride for almost 50 years.

After all of his pushing and all of his investment, after the impossible decision to push IBM to the brink, Tom Watson was rewarded with The Social Security Act of 1935, part of FDR’s New Deal. It was perfect.

No single flourish of a pen had ever created such a gigantic information processing problem. The act established Social Security in America—a national insurance system that required workers to pay into a fund while employed so they could draw payments out of it once they retired, or if a wage-earning spouse died. To make the system work, every business had to track every employee’s hours, wages, and the amount that must be paid to Social Security. The business then had to put those figures in a form that could be reported to the federal government. Then the government had to process all those millions of reports, track the money, and send checks to those who should get them.

Overnight, demand for accounting machines soared. Every business that had them needed them more. An officer for the store chain Woolworth told IBM that keeping records for Social Security was going to cost the company $250,000 a year. Businesses that didn’t have the machines wanted them. The government needed them by the boatload.

Only one company could meet the demand: IBM. It had warehouses full of machines and parts and accessories, and it could immediately make more because its factories were running, finely tuned, and fully staffed. Moreover, IBM had been funding research and introducing new products, so it had better, faster, more reliable machines than Remington Rand or any other company. IBM won the contract to do all of the New Deal’s accounting—the biggest project to date to automate the government…

This period of time became IBM’s slingshot. Revenue jumped from $19 million in 1934 to $21 million in 1935. From there it kept going up: $25 million in 1936, $31 million in 1937. It would climb unabated for the next 45 years. From that moment until the 1980s, IBM would utterly dominate the data processing industry—a record of leadership that was unmatched by any industrial company in history.

(Source: The Maverick and his Machine)

By combining aggressive opportunism and a great deal of luck, IBM was forged in the depths of the Great Depression. Like John D. Rockefeller before him, who bought up refineries during periods of depression in the oil industry, and Warren Buffett after him, who scooped up loads of cheap stocks when the stock market was crumbling in the 1970s, Watson decided that pushing ahead was the only way out.

History certainly didn’t have to go his way — FDR might not have been elected or might not have been able to enact Social Security. Even if he’d done it two years later, IBM still might never have made it.

But Watson’s courage and leadership did open the possibility of serendipitous fortune for IBM if the world didn’t end. Like oxygen combining with fuel to create internal combustion, those elements forged a monstrous competitive advantage when the match was finally lit.

Still Interested? Check out the excellent The Maverick and his Machine by Kevin Maney, where the excerpts above come from.